I’m going to tell you a story about one ingenious business model that the majority of people are not aware of. It costs average US household around $400 per year. To understand the model, you’ll need to understand three economic concepts: what the penny gap is, the razor and blades business model and Milton Friedman’s concept of there being “no such thing as a free lunch.”

Do you know what the penny gap is? If not, it boils down to this one eternal truth: people are cheap. They love free stuff and hate getting their wallets out. Even if you raise a price from free to one penny, the majority of people will refuse to pay that ridiculously tiny amount, unless they really need the product you’re selling. This obviously sucks for businesses.

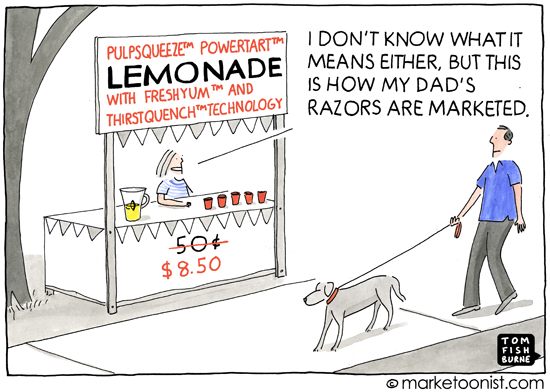

Which is where the razor and blades model comes in, trying to get around the age-old problem of people being cheap. The trick is this — businesses lure customers in with some cheap product (like razors) or give it away for free. Well, “free.” Think: a free phone with a cellphone plan. The moment companies attract new customers, they then make money on the things the customers need to make the product work or via their service costs. Examples are inkjet printers and ink cartridges, phones and phone plans, gaming consoles and the games that go with them. And, of course, razors and blades — doubly so thanks to Gillette’s elaborate marketing claims of “innovative shaving technology”.

Businesses that succeed in pulling this off make so much money that even Scrooge McDuck drools over their profits. But there’s a catch — they’re going to need to lock customers in. These same companies don’t want competitors with low margins. So how do they stop someone from going to the cheaper ink cartridge shop down the road? Businesses add security modules to ink cartridges, patent blades, often lock phones to one carrier and make sure you can only use licensed games with their corresponding games console.

And sure, it’s smart. But no matter how streamlined their razor and blades model is, it still doesn’t solve the penny gap issue because customers still need to make peace with paying more money for additional products. Customers are human, which means they’re all about saving some of those dollar bills. They bellyache about the blade prices, fill ink cartridges with cheap replacement ink or switch their phone plan as soon as the contract is up. And businesses using the model may get rich, but their customers think they’re basically Satan with a tax identification number.

So what if you could hide those recurring costs? This is the ingenious part:

Indirect razors and blades model is an extension of the razors and blades model, where customers are not aware of the recurring costs, because they pay them indirectly.

Which is exactly what credit card companies do. Customers get credit cards for free. As a result, the average American owns 2.6 credit cards.

Then, every time a customer uses a credit card, there is a credit card processing fee. According to Helcim Inc’s list of interchange fees, US Mastercard and Visa credit card fees are between 1.51% and 2.95%. That doesn’t include extra fees like chargebacks or set-up fees.

Most customers don’t think about the processing fees, because they assume the businesses are shouldering those costs. However, economists know that there ain’t no such thing as a free lunch. Shops aren’t charities and they’re not going to donate money just for the hell of it. They calculate all of their business costs and then add their margin to it. Consider the following examples of “free” stuff:

- Restaurants with “free service” which cost more more than self-service restaurants.

- Business with “free parking” which cost more more than those without.

- Shops in expensive rental locations which have higher prices than the same shops in cheap rental locations.

As such, the effect of processing fees on the final price depends on how many customers use credit cards. If everybody used credit cards, the average price of goods would rise by around 2%. So if you had a choice between buying a laptop with a credit card for $500 or with cash for $490, would you still opt for a credit card? Presumably most people would opt for $490 and would spend the change on lunch. But you don’t have a choice.

You’re not given that option for two reasons. Firstly, for many businesses it simply isn’t convenient to add a credit card surcharge. Secondly, even if businesses wanted to do that, surcharging everyday transactions is illegal in 10 US states. Molly Faust, spokeswoman for American Express justified their legal stance in the following statement: “We believe that surcharging credit card purchases is harmful to consumers.” How sweet of them to be so concerned for consumers’ well-being!

As a result, most businesses charge the same price regardless of whether a customer pays via cash or card. Which means all customers share the burden of credit card fees. If 50% of Acme Donuts’ customers use a credit card with a 2% fee, then the average price of donuts will be 1% higher, even for those customers who pay for their morning dose of sugar with cash. AmEx doesn’t seem to think it is “harmful to consumers” to pay a hidden fee even for customers who don’t own a credit card.

However, credit card companies invented something way better then legal pressure. What if they could motivate customers to flex that plastic all the time, even when it’s not more convenient than paying with cash?

Welcome to reward programmes like Cash Back, Points or Miles. Every time customers use the card they get a “reward”, even though the thing they get is actually their own money back, paid via higher prices. This prompts customers to use a credit card for a $5 drink despite having a $5 bill in the pocket. Unlike razors and blades, where customers try to consume less, in the indirect razors and blades model customers try to spend more. Doubly ingenious.

You can’t quibble with the results. The total credit card volume in the US in 2014 was $4 trillion — enough to “buy a Nissan Versa for every man, woman and a child”. But if that’s the total sales volume, how much do the customers pay in transaction fees after reward programs are paid out? Merchants Payments Coalition calculated that the average household in the US pays more than $400 annually in credit card fees. If customers knew in advance that they would have to pay over $400 per year, would they still use credit cards?

Which raises the question:

What can we, as a society, do about the credit card fee problem?

The Fight Club Approach

This is the radical solution your college-era socialist self would have been proud of: fighting against “evil” banks and credit card companies.

Unlikely as it sounds, this is exactly the approach taken here in Berlin. American visitors to the city are always shocked by the fact that establishments big and small refuse credit cards. Berlin is cheap and prides itself on being alternative. So it’s not exactly surprising that so many shop owners are trying to lower the costs by refusing credit cards.

There’s no disputing the anarchist charm of this. But I think that in the long run, it’s a little silly. Electronic payments are convenient and the future of currency; we can’t just ignore them.

Passing The Hot Potato Approach

This is the legal approach where countries adopt laws which limit how much credit companies can charge, in which ways they can charge, and who foots the bill.

For example, in 2014, the EU introduced legislation limiting credit card fees to 0.3% and debit card fees to 0.2%.

Similarly, in 2013, an anti-trust settlement in the US placed a cap on the fees that banks can charge merchants for handling debit card purchases. This was rolled back in 2016.

Lobbying for the law can be well-intentioned but ultimately useless: it doesn’t solve the structural payment problems. Since the cost of technology remains the same, the credit card companies just end up shifting costs elsewhere. For example, you can limit the processing fee, but the credit card companies and banks then just ask for extra money elsewhere to cover their costs, like raising or establishing set up fees and monthly maintenance fees.

A Proposal For A Modern Solution

We need to understand why fees are so high. In my opinion, it boils down to three components: high margins, high fraud rates and expensive proprietary transaction systems.

The margins in the US are set by payment networks such as Visa. The two largest credit card companies, Visa and Mastercard, have such a chokehold on the market that they change their interchange fees twice a year, in April and October. At the end of the first quarter of 2017, Forbes cited the ten largest card issuers in America as accounting for “almost 88% of total outstanding card balances in the country.” It is extremely hard for a new company to break into this market, as major players have one key advantage: network effect. Legislation needs to be made to help smaller, more efficient competitors carve out a slice of the market.

High fraud rates is a colossal problem for current credit card technology. The Nelson Report calculated that in 2015 credit card fraud totaled $21.84 billion. But that report doesn’t take into account the indirect costs of fraud, like the costs of issuing replacement cards or the cost of prevention. In 2016, LexisNexis estimated that for every $1 of direct fraud, there is $2.4 of indirect costs. “Yeah, and? Why should I care? The fat cat credit card companies cover that cost.” Again, because of Milton Friedman’s “no such thing as a free lunch.” You’re shouldering the cost of credit card fraud via increased credit card fees. Current credit card technology is inherently insecure.

And finally, the third issue is that in order to validate credit card transactions you need to use the backend provided by credit card companies. They are proprietary, legacy systems that have no incentive to cut costs.

And because of the issues above, fees are higher than they should be. But by how much? For comparison, at the time of writing (August 2017), the average bitcoin transaction fee was 0.56%. Realistically, this isn’t the best comparison, because bitcoin architecture only rewards the miners who win the arms race for best custom hardware. Still, it is obvious that modern crypto-currency can deliver inherently safe transactions at a much lower cost than current credit card fees.

In my opinion, in order to change the status quo that has existed for the last half a century, legislators need to pass bills which address these issues. In the 21st century, electronic payments are a vital part of common infrastructure, just like roads, the postal service or the internet. And if you look back in history, there’s a particularly relevant comparison to be made. Credit card companies today can be compared to the railroad tycoons of the 19th century. After they built the railroads across the US these same corporations had the power to “squeeze out competitors, force down prices paid for labor and raw materials, charge customers more and get special favors and treatments from National and State government.” Sounds familiar, right? Sometimes two companies would compete on the same route with different track width and different train specifications, as was the case with parts of the New York subway.

What we need now is government intervention, much like how President Eisenhower’s administration introduced the national network of highways that was the US interstate project and helped solve the transport issue. Private companies built portions of interstate highways (and made a profit), but all highways were built to the same exacting standard, connected to each other in an meaningful nationwide network, open for use by all citizens, and connected parts of the country that were of vital interest.

So legislators, if you’re reading this, instead of spending time on laws which cap fees or pass them round the economy like a hot potato, consider focusing on laws which make the payment system more efficient.

The government could demand:

- Transaction security: Future electronic payments protocols must be cryptographically safe, which will eliminate fraud costs. That’s a win for companies, and win for consumers.

- Openness: Popular electronic payments protocols need to be open and have transparent charging.

- Competition-friendly: Small companies should be able to connect to the open payment network and offer transaction validation service over their servers, encouraging healthy competition.

If each of the above ideas is implemented, there won’t be a need to limit credit card fees. With multiple companies competing over a modern, cryptographically safe protocol, fees will naturally go down. That old Adam Smith chestnut, the invisible hand of the market will do its job. It might even give us a thumbs up.

We’ll have laid the bricks for a road leading to innovation, not away from it. And hey, things can stay flexible. It’s no big deal if new protocols are introduced, as long as they satisfy security, openness and pro-competition requirements.

Compare that to the current situation where new players like Apple Pay and PayPal offer better technology but are still proprietary systems. If Apple succeeds in dominating the market as we know it with Apple Pay, then they’ll be the new king of indirect razors and blades model, and will probably respond to that power much as pretty much any being or organization responds to dominating a market: by taking advantage of consumers. What is even worse, governments over the world already are familiar with exactly the kind of legislation I’ve outlined above, but for different markets. Just peep regulations for energy markets or TV and radio broadcasting. They are all run by private companies, but legislators understand that electricity and broadcasting need to be run in a way that’s in the public’s interest — they grasp one basic rule of economics. Namely, that it isn’t in the public’s interest to allow monopolies.

Meanwhile, the credit card industry still seems to be stuck around the decade Mad Men was set in. And funnily enough, my nostalgia for the era of the Beach Boys doesn’t extend to how financial security was handled back then. Every time I hit a restaurant I’m worried that the waiter is going to copy out my credit card details to support his online gambling habit — because it is so freaking easy. But hey, I shouldn’t worry, because 2% credit card fee includes insurance against this current, inefficient system.

Whether or not you agree with the exact improvements I’ve outlined above, it’s clear that the system needs reform. If you agree that current credit card system is ridiculous in modern day and age, share this article.

Authors: Zeljko Svedic and Sophie Atkinson. Reprints are possible under the terms of the Creative Commons BY-NC-ND License, but please send us an email.